By Dr Housing

Let me be abundantly clear. We still have a Pay Option ARM and Alt-A mortgage problem. This will hit in full force in 2010 and we are already seeing many mortgage holders having trouble with actual recasts brought on by negative amortization. Yet there is a crew of people saying that Alt-A mortgage products will not bring any trouble because of the low interest rate environment. Unfortunately the low rate misses the bigger issue. Low rates are helping but the problem that we will be seeing is the massive onslaught of recasts, not resets that will be occurring over the next few years. This is a big reason why we won’t see a housing bottom in California until 2011 at the earliest. Many of these loans were made to supposedly better qualified borrowers in mid to upper priced areas. These areas will begin to crack like an egg dropped on the floor late in 2009. The Notice of Default tsunami will guarantee this much.

I’m am stunned that some people are actually saying that Alt-A mortgages or Pay Option ARMs will create little problems in the market. Okay. Then how about we remove the public-private investment program that conveniently has a cap with the FDIC of $500 billion? After all, if there isn’t any problem with toxic mortgages why should we have a toxic mortgage program that has the design to eat up $1 trillion in loans. Exactly. Let me break down the latest figures from data by none other than the Federal Reserve:

California

At the end of March 2009

Subprime loans active: $119 billion

Alt-A loans active: $288 billion

U.S.

Alt-A active: $469 billion

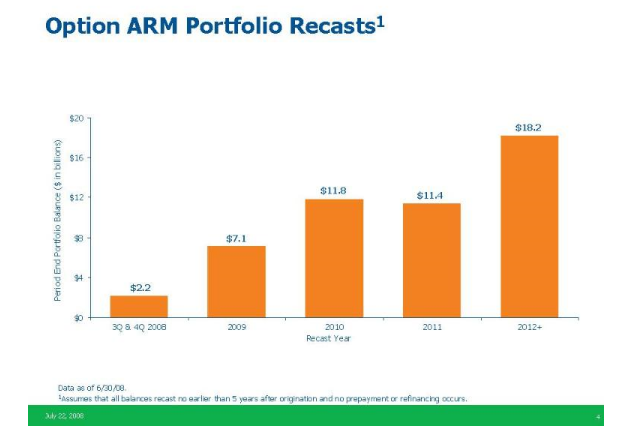

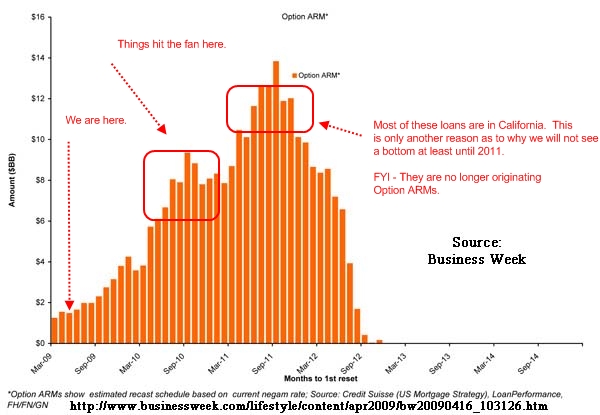

When we talk about the $500 billion in Alt-A mortgages this is what we are talking about. Last time I checked $469 billion does not mean the problem has gone away. Businessweek came out with a chart only last month showing how Pay Option ARMs will be recasting over the next few years:

Click for sharper image

I’ve added a reference point for all those people who seem to think that Option ARMs and Alt-A loans have somehow disappeared from the market. The game is just starting. Currently, we are seeing less than $2 billion per month of these loans recasting. However, in 2010 we are going to start seeing $8 to $10 billion per month recast, nearly 5 times the current rate. The chart states “months to 1st reset” but they are referring to recasts brought on by negative amortization. And as you will see, since the majority of these loans are in California the bulk are underwater Jacque Cousteau style.

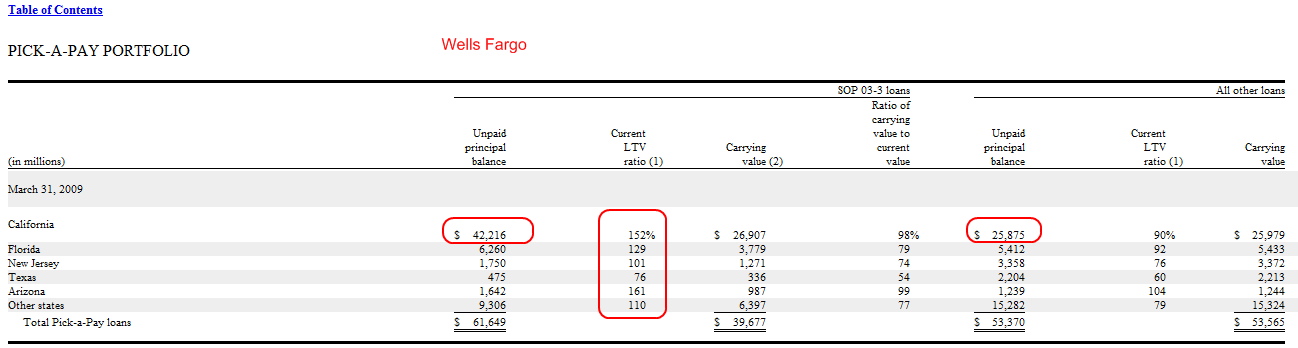

Wachovia in their infinite wisdom swallowed up Golden West at the height of the lending insanity. This cratered the bank which was taken over by Wells Fargo. Just because you eat a bank doesn’t mean the toxic waste suddenly disappears. In fact, there is still well over $100 billion in Pick-A-Pay mortgages in their portfolio. Wells Fargo has written off a portion of the portfolio but there is still a significant amount remaining:

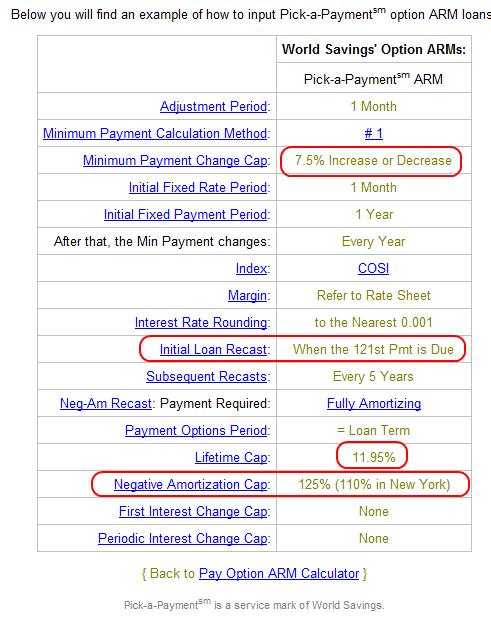

This is from their most recent 10-Q. Wells Fargo alone has $42 billion in unpaid principal linked to Pick-A-Pay mortgages here in California. The Pick-A-Pay was basically the Pay Option ARM World Savings Style. Here were the terms:

Source: Mortgage X

These are the crappiest loans in the world. World Savings which was owned by Golden West thought that by simply having a little more collateral and looking at FICO scores that handing out toxic waste would be smart. Some of these insane loans don’t have the first adjustment until 10 years later! Of course, if Wells Fargo had any sense they would look at that absurd 152% LTV and freaking recast the entire lot. Somehow I doubt they are doing this since they are too busy sucking up taxpayer money through the crony bailout and pretending everything is fine through manufactured stress tests. Look at the LTV on some of the toxic foursome. Arizona actually beats California out with a 161% LTV which is astonishing in itself. But again, out of this little section of $61 billion in Pick-A-Pay loans $42 billion are in California, a state that has seen the median price drop by 50% in one year.

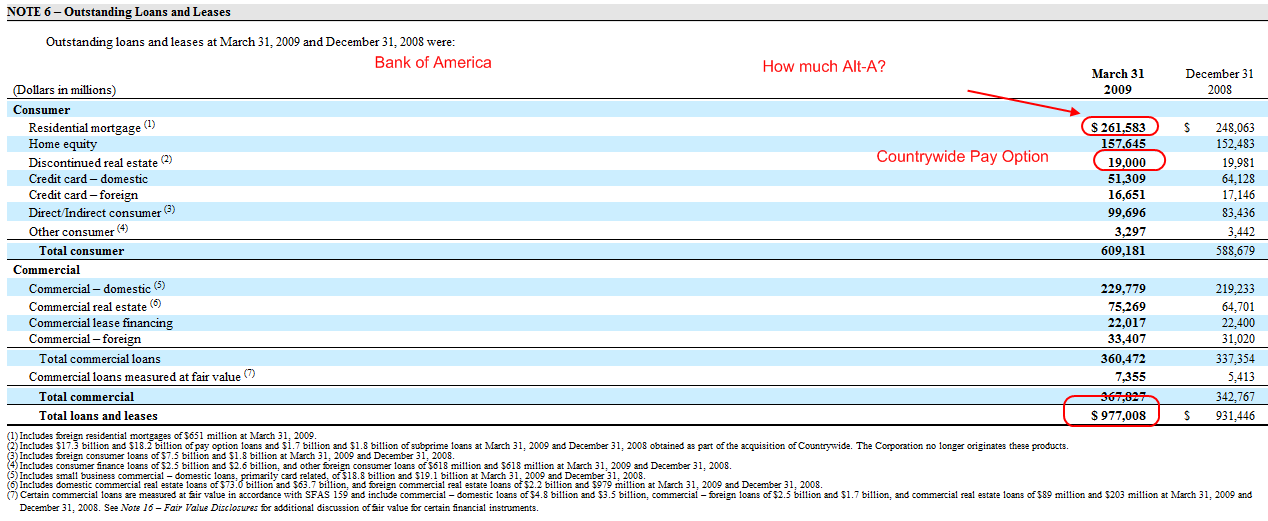

Wells Fargo seems to have the biggest amount of this crap on their books. Yet Bank of America and JP Morgan now have a lot since they acquired toxic mortgage experts Countrywide Financial and WaMu. Let us first look at Bank of America:

Advertisements | Naples Caterer | Naples Graphic Design | Bible Covers

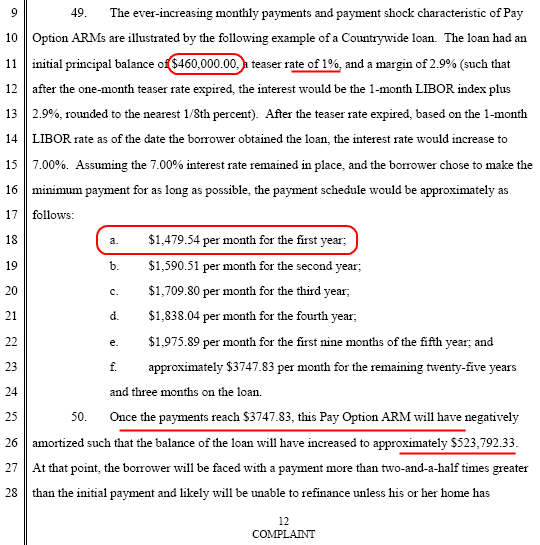

Bank of America has $20 billion in Pay Option ARMs courtesy of Countrywide. But keep in mind Countrywide was a toxic mortgage expert and other Alt-A crap producer. They are the 31-Flavors of toxic waste. We can find some of that junk in the whopping $261 billion residential mortgage portfolio. If you haven’t realized it yet, if you lose your job any mortgage becomes toxic if you are underwater and can’t make the payment. So many of these “prime” loans are equally bad. The only difference is these Pay Option ARMs are monstrosities of epic proportions born in the laboratory of financial meth labs. Take a look at what the California Attorney General shows through one glorious example of a Countrywide Pay Option ARM:

Here we get a firsthand look of a toxic mortgage product in action. This is for a $460,000 loan which is what is sitting in many of those mid to upper priced areas in California. Initially, the first year payment is $1,479 which of course is absurdly low. But by the time we hit the first 5 year adjustment our payment jumps up to $3,747! The payment more than doubles. These craptastic loans were made throughout the bubble from 2004 to 2008 (yes, 2008 with freaking Wachoiva). A large number of these will have major adjustments in 5 years (that is why we are seeing the first batch now) while some like the idiotic Pick-A-Pay loans can go on for 10 years. Like I stated before, I highly doubt that Wells or BofA are going to push to recast many of these loans since they are going to fold the minute they do it. Most people in these loans can’t sell and are basically renters. That is until they hit recast and you will be seeing some massive moonwalking from homes. Yet buyers are walking because they are not building equity (aka, renting). If you bought a place for $500,000 and now know it is worth $250,000, you might make that $1,500 a month payment but are you going to make the payment once it goes up to $3,700? Heck no! You are out. These banks are praying the market will recover. It will not. At least not under their delusional expectations and V-shaped bubble recovery plans.

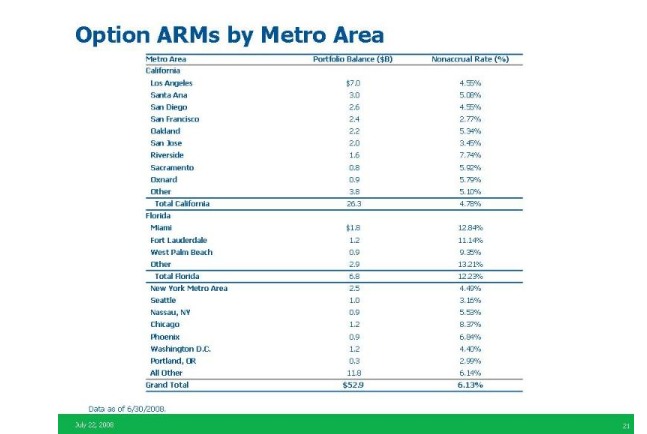

Let us look at JP Morgan who ended up swallowing up WaMu, another Pay Option ARM fanatic. Before WaMu went under like the titanic they had a gigantic amount of Pay Option ARMs:

Right before WaMu bit the banking dust, it had $52 billion in Pay Option ARMs. And where were the bulk of these loans? If you guessed California you win a prize:

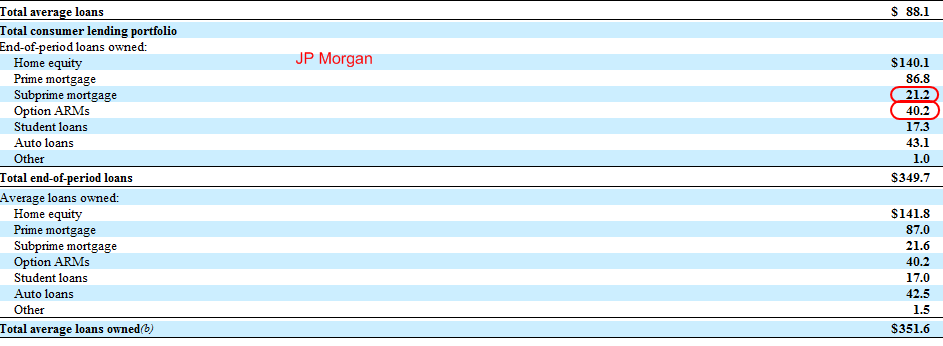

Now JP Morgan wrote down a large part of this portfolio. But how much of it? That is the real question. If we are to take the stress test as any guide, banks are still insanely optimistic of potential losses. Let us pull up the latest 10-Q for JP Morgan:

According to the above, they still have $40.2 billion in Option ARMs and $21 billion in subprime loans. But another major issue that I won’t address here but should be obvious is that massive “home equity” line item. JP Morgan has $140 billion in these loans. Many times, these loans are combined with Pay Option ARMs which makes for a dynamic duo of crap. These loans are secured by home equity which doesn’t even exist anymore! These will implode simultaneously as things get worse with these loans. In the Pick-A-Pay portfolio with Wells, the majority of people make the minimum payment meaning negative amortization. Meaning, the bank most likely will recast the product based on the appraised price at time of sale. Many will say otherwise but this is the only logical conclusion. If we are to appraise those loans in today’s current market, the vast majority of the portfolio would shatter the 110% or 125% (insane) caps and all these mortgages would hit recast oblivion. I doubt that since banks are waiting for the PPIP so the taxpayer can assume the position at the worst time. And that is why this problem hasn’t been solved. I’ve heard a few misguided pundits say that most of these loans have been refinanced. Sorry, the data above doesn’t show that. Most of these are still out there. The only refinancing going on with these toxic mortgages occurs in the foreclosure process.

So why has refinancing activity picked up? Because buyers in no financial trouble have taken advantage of the low mortgage rate environment and this is smart. But don’t think all the activity was because of subprime and Alt-A borrowers running to get new government backed mortgages. They don’t qualify!

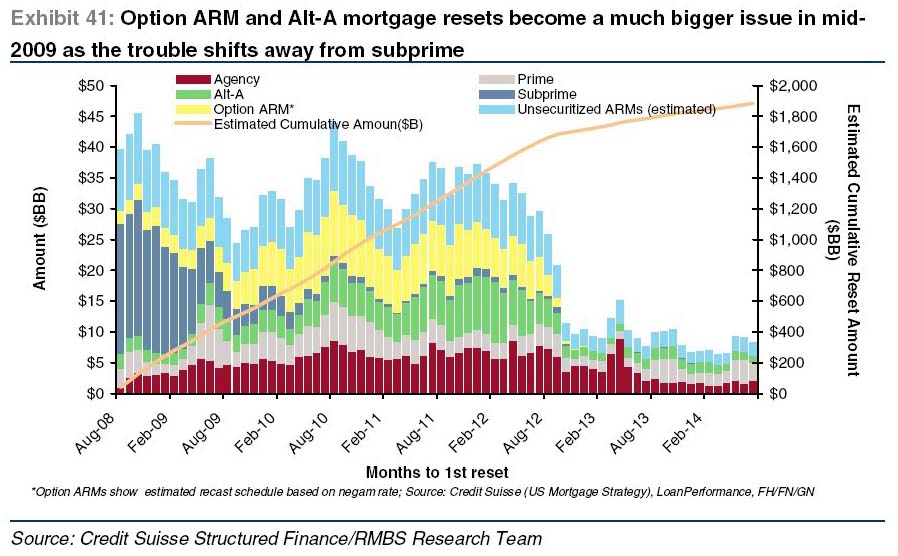

I’ll leave you with the most recent graph from Credit Suisse:

The big hit is going to be in 2010. With 135,000 Notice of Defaults in California for Q1 of 2009, the second half of the year is going to expose the eye of the hurricane we are currently in. The pundits who say these loans have been taken care mistake silence with a problem being solved. The data does not back them up but since when do we expect pundits to pay attention to data?

No comments:

Post a Comment